About us

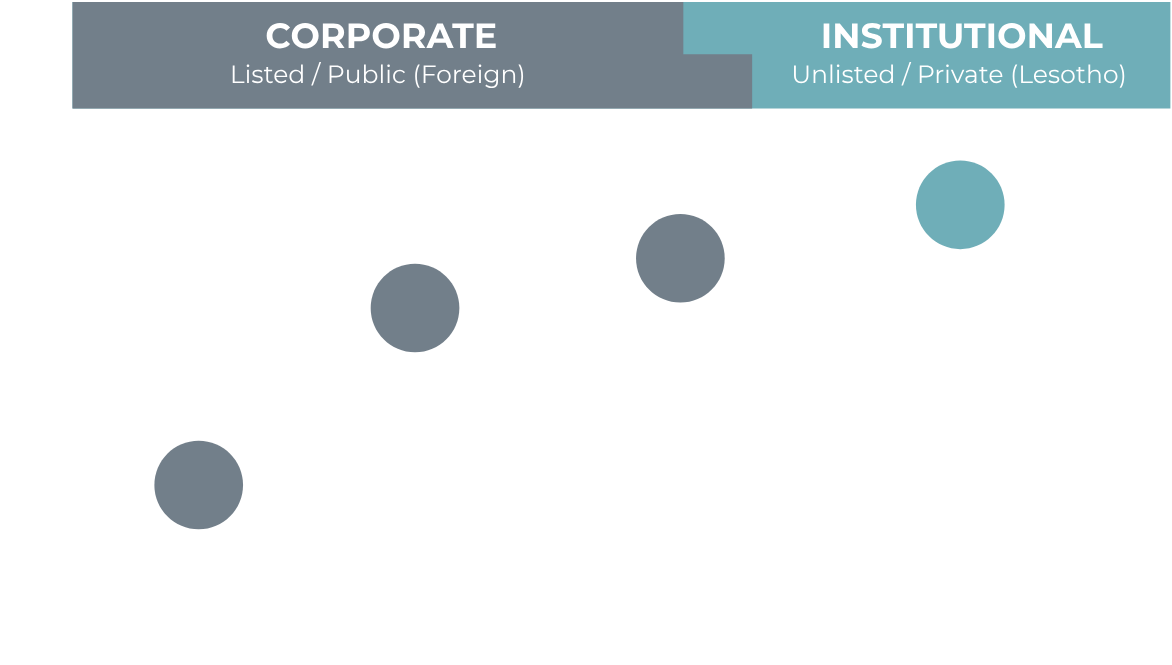

Mergence Investment Managers (Lesotho) (“Mergence Lesotho”) is a licensed financial services provider registered and regulated by the Central Bank of Lesotho. Our first mandate harnessed our extensive experience in managing unlisted assets, thus bringing to market a manager to invest in local infrastructure and developmental assets.

Our product range was extended to offer access to our South African unit trusts under the collective investment schemes, hence granting access to additional vehicles to individual investors to save for their future.

News & Insights

Rate cuts come to those who wait…

In a wide-ranging interview with FAnews, the intermediary portal, Mergence CIO Brad Preston chatted to Gareth Stokes about the likelihood of interest rate cuts, a soft or hard landing for the markets, and how Mergence is positioned to best benefit from likely scenarios.

Multichoice in French hands? Clever manoeuvring will be required.

An African media powerhouse? Will Canal+, the French-based media house, succeed in circumventing SA ownership restrictions? Peter Takaendesa, TMT specialist and Head: Equities at Mergence Investment Managers, says the offer price of R46 billion looks decent but here is a chance that shareholders will ask for a bit more.

Mergence Namibia promoting infrastructure growth and sustainability transition

In the annual high-level Namibian publication, The Brief, Hileni Nghinaunye, Portfolio Manager at Mergence Unlisted Investment Managers (Namibia) writes a overview of Mergence’s impact investments in Namibia and the launch of Fund II.

Contact Us

Mergence Maseru

House 369 Malibamats’o Street

Lower Thetsane

Maseru, Lesotho

Mergence Cape Town

2nd Floor Cape Town Cruise

Terminal Duncan Road, V&A Waterfront

Cape Town

F +27 21 433 0675

Mergence Windhoek

Heritage Square

1st Floor, Building No.2

c/o Robert Mugabe Avenue & Lindequist Street Windhoek

T +264 (0)61 244 653

Mergence JHB

Block A1, 34 Impala Rd, Chislehurston,

Sandton, Johannesburg, Gauteng,

South Africa

T +27 11 325 2005

F +27 11 325 7597