Telkom confident about its ability to pay for growth

Telkom says it is confident it can fund its planned growth into an infrastructure company but some market pundits are sceptical of Telkom’s balance sheet. Peter Takaendesa, Head: Equities at Mergence Investment Managers, says that the entity will probably need to sell more assets or allow strategic partners to fund the transition.

Nightmare in Nigeria: more pain for MTN

Ann Crotty of Financial Mail reports extensively on MTN, its exit from the Middle East and increased focus on Africa, including a troubled situation in Nigeria. Mergence Head: Equities, Peter Takaendesa, added insights to the article.

MTN says its SA network has improved, but it takes currency and conflict hits

Peter Takaendesa, Head: Equities at Mergence Investment Managers and telecoms expert, commented in News24 on MTN following the company’s recently released quarterly results.

Is a rate cutting cycle good news for stocks?

Last week, global equities staged a strong recovery as the Fed held rates steady and struck a more dovish tone, hinting that the current rate-hiking cycle may be over. Is this a cause for bullishness? Will the inevitable rate-cutting cycle be positive for stocks when it comes? To test this question, we compare the 12-month […]

Is a rate cutting cycle good news for stocks?

This week, global equities staged a strong recovery as the Fed held rates steady and struck a more dovish tone, hinting that the current rate-hiking cycle may be over. Is this a cause for bullishness? Will the inevitable rate-cutting cycle be positive for stocks when it comes? To test this question, we compare the 12-month […]

Mergence sees opportunity in infrastructure

How does one broaden the scope of infrastructure into portfolios given liquidity constraints and a limited universe in public markets? Private market investments are the best route for now, explains Kasief Isaacs, Head: Private Markets at Mergence Investment Managers.

Beauty is in the eye of the fund holder?

The correlation between a fund manager’s physical attractiveness and their investment performance has sparked intrigue. Recent academic research by two Chinese scholars suggests that “funds with facially unattractive managers outperform funds with attractive managers by over 2% per annum.” Additionally, they argue that despite generally inferior performance, “good-looking managers attract significantly higher fund flow, especially […]

“Signicant” investment beckons for SA’s e-commerce market

Where to e-tail in SA given Amazon’s recent official launch? Mergence Head: Equities, Peter Takaendesa, spoke to ITweb about Amazon’s potential threat to existing players, and the scope for competition given that SA’s e-commerce sector is still in its infancy.

The opportunity in SA Bonds

19 October 2023 The chart below illustrates the current opportunity on offer in bonds for the South African investor. It shows the progression of 5-year inflation expectations in South Africa vs. the yield on the JSE All Bond Index. While the yield on SA bonds has steadily increased over the past decade, long-term inflation expectations […]

Where to from here for real yields?

12 October 2023 Last month, US bond yields reached the highest level in 15 years. The surge in nominal bond yields has coincided with an increase in real yields, the yield paid above inflation on Treasury inflation-protected securities (TIPS). Over the decade from 2013 to 2022, this yield averaged just 0.14%. It has been a […]

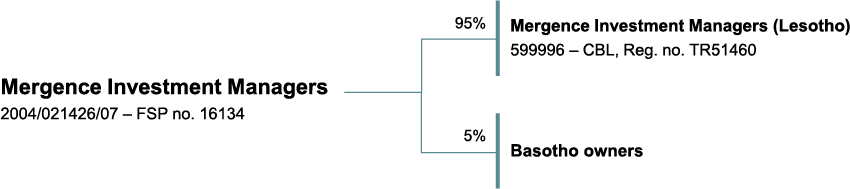

Harith-led consortuim buys controlling stake in Mergence

The Harith-Mergence deal, including the acquisition of a 5% stake in Mergence by a black women-led entity will drive consolidation and scale creation that will bolster Mergence’s role in the financial services sector.

How accessible is Infrastructure as an asset class in South Africa?

5 October 2023 Recent changes to Regulation 28 allow pension funds to allocate up to 45% to infrastructure investments. The benefits of adding infrastructure to a portfolio include diversification, reduced volatility (particularly from infrastructure debt allocations), more resilience in changing markets conditions, etc. Infrastructure investing can act as a catalyst for stimulating long-term economic development […]